transfer car loan to another person uae

Selling the car of a deceased owner is more of an emotional decision but to finish off all the paperwork is another hassle. To transfer car ownership from one Emirate to another you will have to first get the vehicle de-registered from one Emirate and get it marked for export to another Emirate.

3 Tips If You Re Facing Auto Loan Default Credit Karma

After the refinance loan is signed by your transfer partner the loan has successfully been transferred to a different name.

. Export number plates are only for transporting outside of the country a representative from. There are two primary ways to transfer a car loan to another individual. To do this you need to visit the closest Regional Transportation Office RTO.

Plus the Central Bank has said that lenders and other finance companies are also expected to slash the. There may be charges applicable for this. If you do not keep up your repayments you may lose your vehicle as the vehicle is mortgaged to the bank as security and the bank has the right to enforce the security.

So if youre wondering how to transfer a car loan to another person in the UAE. Once given the all clear the new owner must pay the transfer fees. Seeking a new lender will end up costing you more but the new borrower will likely see.

The new owner must arrange for lorry transport to the new location which costs Dh400 to Dh600. Customers who have a residence visa from another emirate must meet one the below conditions to register a vehicle. Union National Bank New Car Loan with salary transfer.

Submit all documents including the vehicle permit application at the registration desk. Modifying with your existing lender will present the least penalties to you but it may not be the best deal for the new borrower. The cost of vehicle ownership transfer is AED 350 and the new number plate between is AED 35 to AED 500 depending on the size and type of the plate.

When applying for changing a vehicle ownership the customer must apply for registration export possession or transfer service. Send the request from the e-mail address registered with the bank. Union National Bank Used Car Loan with no salary transfer.

Under the new rules borrowers can now transfer their personal loan from any bank in the country in return for an early repayment commission not exceeding 1 percent of the remaining amount of the loan or Dh10000 whichever is lesser. The UAE Central Bank has also stated that lenders and. We compare fees charges and eligibility criteria compare Dubai banks for car loans to find.

Small car number plates can be obtained for AED 35 long for AED 50. Mention Auto loan Agreement ID or 20 digit Auto loan account number along with the registered mobile number with the bank. The next step is to modify the title of the car to reflect its new owner unless some deal was worked out beforehand where the original loan holder retains ownership.

Once the loan is paid off your bank informs the Road and Transport Authority RTA to update the records and clear the loan from the RTA system. A knowledgeinnovation fee is usually applied at AED 20. As per the new rules borrowers can transfer their personal loan in Dubai from any bank located in the country in exchange for an early repayment commission which does not exceed 1 percent of the outstanding amount of the personal loan in Dubai or AED 10000 whichever amount is lesser.

The transfer of a vehicle from. This service is free of cost. Modify with your existing lender or seek a new lender.

The customer must be an investor in Dubai property or facility owner. If you do not meet the repayments on your loan your account will go into arrears. How Does Money Transfer Work.

As a seller you need to clear any outstanding finance mortgageloan you have availed from a bank to purchase your vehicle. Since Dubai RTA does not issue number plates for cars being moved within the UAE. Processing this request may take up to two weeks.

The car will have to be registered at the new Emirate following the steps mentioned above. Compare car loans in UAE to find the best auto finance for you. This means there is no need to wonder how to sell a car with a loan in the UAE.

Loan repayment period is up to 48 months. You may have to pay penalties if you pay off a loan early. Once the vehicle registration transfer is done the buyer will get the new number plate and new registration card for the car.

If there are any outstanding fines they must now be paid off by the seller before vehicle ownership can be transferred. The authorities will have to do a background check with the bank before they change the name in the Registration Certificate. In Dubai it will cost Dh430 for new number plates.

Pick the time place Authorized locations. Unlike other emirates Dubai will not provide export number plates to transport the vehicle from Dubai. Once you have agreed with the seller or buyer on the car transaction and arranged the funds you.

Car Loan Tax Benefits And How To Claim It Icici Bank

Can I Get A Second Car Loan If I Already Have One Blog Camino Federal Credit Union

How To Get A Used Car Loan Experian

Top Up Loan On Your Existing Car Loan Bankbazaar

How Do I Qualify For A Car Loan Experian

What S The Catch With Zero Percent Financing Car Loans Autotrader

What S The Average Car Loan Length Credit Karma

Can You Pay A Car Loan With A Credit Card Smartasset

New And Previously Owned Car Loans Consumer Loans Hsbc

Low Auto Rates Thrill Members Pittsford Federal Credit Union

0 Apr Car Deals Are They Worth It Forbes Advisor

How To Transfer A Car Loan To Another Person Finder Canada

Steps On How To Get A Car Loan Car Loan Process Approval And How It Works

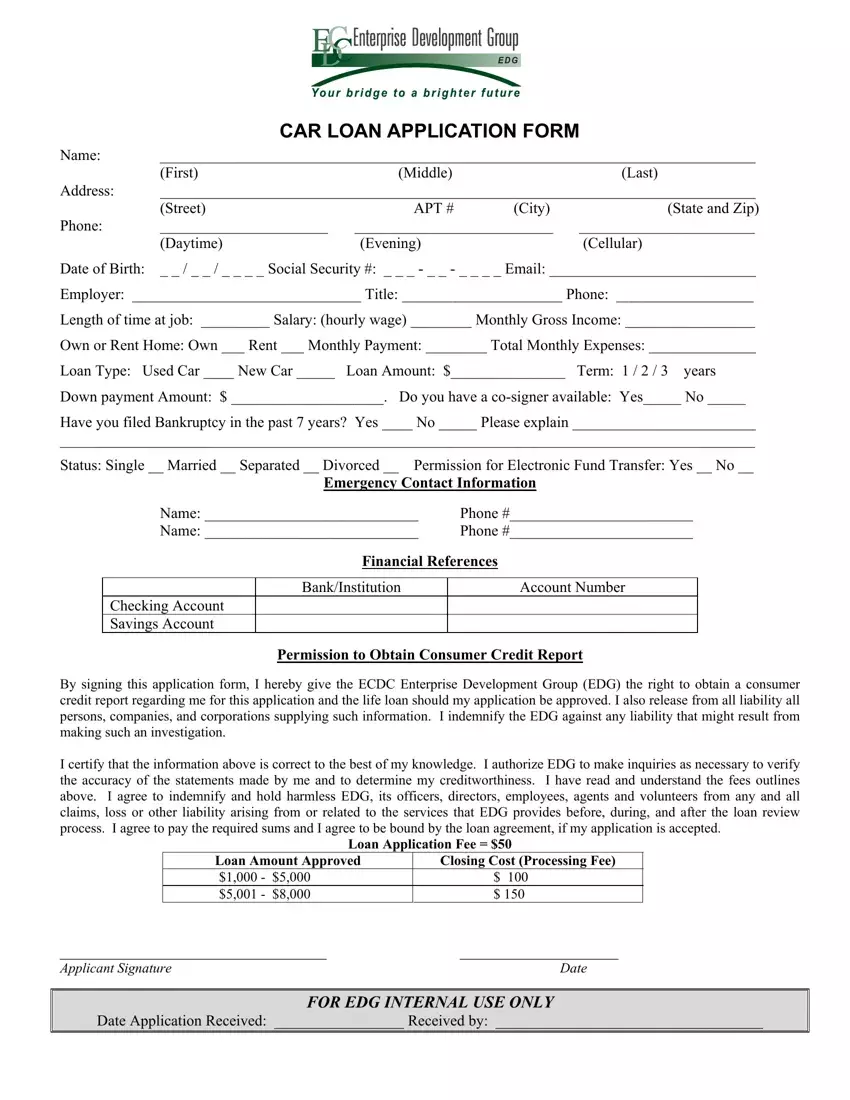

Car Loan Application Form Fill Out Printable Pdf Forms Online

How To Get A Car Loan With Bad Credit Experian

Car Loan Closure Procedure At All Banks

Types Of Auto Loans Know Your Car Loan Options Lendingtree

Car Loan Options Types Of Car Loan In India Used Car Loan Vs New Car Loan